Top 5 Famous South African Life Insurance Murder Cases (2024)

South Africa faces many challenges as a nation. In recent years, South African insurers have also witnessed an unsettling trend involving life insurance policies. There have been numerous instances where life insurance has been the motive behind grim plots and heinous murders.

These cases send shivers down the spine for their sheer brutality and also highlight the darker side of human greed and the lengths to which individuals will go for insurance money. This article delves into five of the most recent and infamous South African cases where life insurance was at the heart of foul play and murder.

The Concept of Life Insurance Murder

Life insurance murder is a premeditated act where the perpetrator kills the policyholder to claim the life insurance benefits. In many cases, the murderer is listed as a beneficiary on the policy, incentivizing them to eliminate the policyholder to reap financial rewards. Insurance policies, intended to provide financial security to families in the event of a loss, become tools in the hands of those motivated by greed. The notion of benefiting from a policy payout leads some to exploit the very essence of the insurance pact, culminating in the ultimate betrayal through the act of murder.

These nefarious acts take advantage of insurers’ trust, often attempting to disguise the murder as a natural death to expedite the insurance claim. Initially ruled as ‘natural deaths’, these cases often unravel through diligent investigation, exposing the grisly truth behind the supposed accidents or sudden illnesses. Some cases have involved complex schemes, including murder-for-hire plots and elaborate cover-ups, to ensure the insurance payouts are secured, highlighting the depths of manipulation and deceit life insurance fraudsters will resort to. Behind each case is a chilling narrative of manipulation, betrayal, and an insatiable thirst for life insurance money.

Case 1: Nomia Rosemary Ndlovu

Source: IOL

Nomia Rosemary Ndlovu, a former police officer, orchestrated a horrifying series of murders, targeting her relatives to cash in on life insurance and funeral policy benefits. Her cold-blooded scheme led to the deaths of six people, including her boyfriend and five family members, over a span of six years. Ndlovu meticulously planned each murder, employing hitmen to execute her family members while she positioned herself as the beneficiary on their life insurance policies.

Her reign of terror was halted when a hitman, appalled by her request to murder children, turned informant, leading to a sting operation. This operation captured Ndlovu arranging another family member’s murder, providing the evidence needed for her arrest and subsequent trial. In a landmark case, the Johannesburg High Court sentenced Ndlovu to life imprisonment, marking a significant victory for justice. Her case has become a grim reminder of the lengths some will go for financial gain, sparking widespread calls for stricter insurance fraud prevention measures.

Case 2: Segomotsi Agnes Setshwantsho

Source: IOL

Segomotsi Agnes Setshwantsho was arrested under suspicion of murdering several family members to claim insurance money, unravelling a dark narrative of betrayal and greed. Her case came to light following a meticulous investigation by the South African Police Service, initiated after receiving tip-offs from relatives. The investigation revealed Setshwantsho’s alleged involvement in the deaths of multiple family members, with one death initially ruled as natural being reclassified as suspicious, pointing towards a sinister pattern of life insurance fraud.

Denied bail, Setshwantsho’s case has highlighted the urgent need for vigilance among families and insurance companies against such fraudulent schemes. As investigations continue, with further examinations into the deaths of her son, husband, and daughters, Setshwantsho remains a focal point of a broader dialogue on the exploitation of life insurance policies for murderous ends. Her actions have prompted a re-evaluation of insurance claim processes, aiming to prevent similar tragedies in the future.

Case 3: Valencia Nonhlanhla Mthunywa

Source: RiseFMNews

Valencia Nonhlanhla Mthunywa’s conviction for the murder of her mother, Wanter Bajabulile Dlamini, casts a spotlight on the devastating impact of greed within families. Mthunywa, alongside her sister and two others, committed a heinous act of violence against her mother, driven by the motive to claim an R80,000 insurance payout. The brutal murder involved luring Dlamini to a predetermined location, where she was subjected to assault, rape, and ultimately, strangulation. Her body was callously disposed of at a local dumping site, a grim testament to the lengths Mthunywa would go to for financial gain.

The aftermath of the murder saw Mthunywa attempting to claim the insurance money, a move that ultimately led to her arrest and conviction. Sentenced to 20 years in prison, her case serves as a harrowing reminder of the moral decay spurred by the lure of easy money. It underscores the necessity for insurance companies to diligently verify claims and for families to remain alert to the potential for such unfathomable betrayals within their midst.

Case 4: Phumaphi Gloria Gwebu

Source: Vans Live

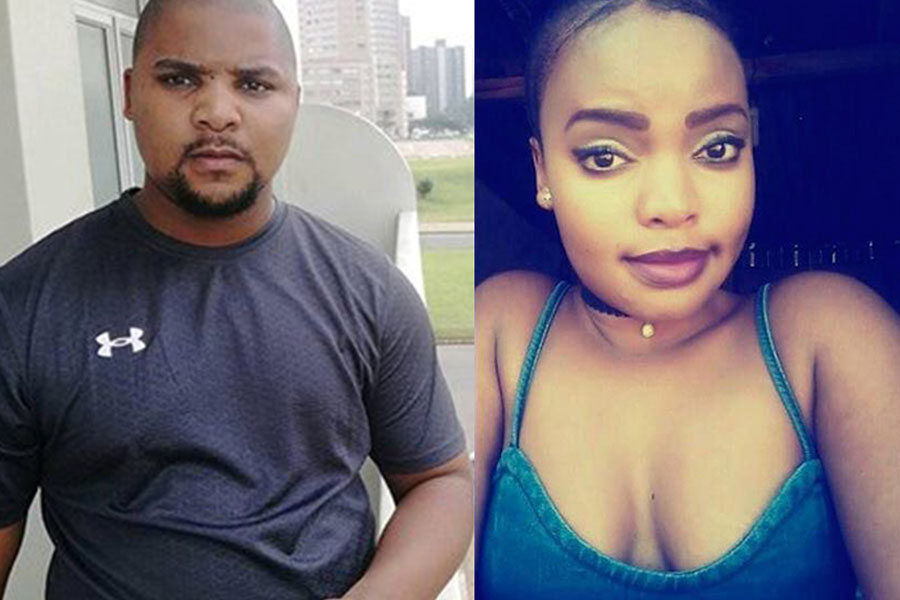

Phumaphi Gloria Gwebu’s life imprisonment sentence for the murder of her husband, Sipho Shadrack Dimba, underscores the tragic consequences of life insurance fraud driven by intimate betrayal. Gwebu confessed to taking out five insurance policies on her husband’s life, planning his murder once the policies matured to ensure a substantial financial windfall. The premeditated murder was executed with chilling efficiency; hitmen hired by Gwebu strangled Dimba to death in their home before disposing of his body in a nearby river. This act of cold-blooded murder was motivated purely by Gwebu’s desire to collect on the life insurance, showcasing a profound disregard for human life.

The discovery of Dimba’s body and the subsequent investigation unveiled the grim reality of Gwebu’s actions. Her arrest followed a year later, catalysed by a confession from one of the involved hitmen. Gwebu’s conviction brings to light the dark side of life insurance policies when twisted by malicious intent. Her case is a cautionary tale about the extreme measures some individuals will resort to for financial benefit, highlighting the critical need for comprehensive investigations into suspicious deaths linked to insurance claims.

Case 5: Pastor Melisizwe Monqo

Source: TimesLive

Pastor Melisizwe Monqo’s life sentence, along with additional years, paints a disturbing picture of manipulation and murder under the guise of religious leadership. Monqo, alongside his wife and a hitman, was found guilty of a series of crimes, including the murder of Hlompo Koloi. The trio insidiously insured the lives of church members and Monqo’s ex-lover, planning their murders to claim life insurance payouts. Their ruthless strategy culminated in the tragic death of Koloi, whose body was discovered with multiple stab wounds, a stark manifestation of their callousness.

The investigation into Koloi’s murder exposed Monqo and his accomplices’ elaborate scheme, revealing their intent to profit from the deaths of unsuspecting victims. The significant sentences handed down to each perpetrator underscore the severity of their crimes and the justice system’s commitment to punishing those who exploit life insurance for nefarious purposes. Monqo’s case is particularly alarming, highlighting the abuse of trust within a community and the extreme lengths to which some will go to enrich themselves at the cost of others’ lives.

The Impact of These Cases on the Insurance Industry

The chilling instances of life insurance murders in South Africa have cast a long shadow over the insurance industry, raising alarms over the vulnerability of life insurance policies to fraudulent exploitation. These cases have prompted insurers to tighten their scrutiny on insurance claims, especially those arising under suspicious circumstances. The necessity for insurers to balance the privacy policy of their clients with the vicarious duty of detecting and preventing insurance fraud has never been more pronounced. The fallout from these cases underscores the complex challenges facing the insurance industry, navigating between honouring legitimate claims and safeguarding against nefarious exploitation.

Moreover, the repercussions of these notorious cases ripple through the industry, compelling life insurers to enhance their fraud detection mechanisms and revise the terms under which insurance payouts are made. The imperative to protect policyholders and beneficiaries from potential exploitation has led to an increased emphasis on investigating the cause of death thoroughly before processing any life insurance claim. These measures, though necessitated by grim circumstances, aim to fortify the integrity of life insurance, preserving its purpose of offering security and financial relief to families in genuine need.

Prevention and Protection

The rise in life insurance murders has underscored the urgent need for strategic prevention and protection measures within the insurance sector. Insurers, in response, are implementing more robust verification processes for policy applications and claims, delving deeper into the relationships between policyholders and beneficiaries. The development of sophisticated algorithms to flag potentially fraudulent activities and the deployment of dedicated investigative teams underscore the industry’s commitment to thwarting insurance fraud. These proactive steps represent a concerted effort to preserve the sanctity of life insurance and ensure that it serves its intended purpose of providing financial protection, not as a motive for crime.

Furthermore, raising public awareness about the dangers of fraudulent insurance schemes is pivotal in combatting this type of crime. An informed clientele is less likely to fall prey to fraudsters or to unwittingly become involved in fraudulent activities. Education campaigns, coupled with stricter legal penalties for insurance fraud, aim to create a deterrent effect. The collective efforts of insurers, law enforcement, and the judicial system are crucial in maintaining the integrity of the life insurance industry, protecting it against those who would exploit it for personal gain.

The sordid tales of life insurance murders in South Africa serve as a dark reminder of the pervasive influence of greed and the lengths to which individuals will go to satisfy their avarice. The noteworthy cases of individuals such as Rosemary Ndlovu and Agnes Setshwantsho, among others, have not only led to tragic losses of life but have also sparked vital conversations around the safeguarding of life insurance practices. As the insurance industry continues to evolve in response to these challenges, it remains imperative that all stakeholders, from insurers to policyholders, maintain vigilance and integrity to ensure that life insurance fulfils its noble purpose of offering peace of mind and financial security in times of genuine need.

If you’re looking to get true peace of mind for your loved ones, you can get a free quote from a reliable insurer by filling in the form at the bottom of this page.

Insurance.co.za Content Team

We’re a specialist team of insurance and finance copywriters and content producers. The Insurance.co.za Content Team is a flexible and dynamic team. Hence we publish our content under the Insurance.co.za brand name rather than our personal names.

Other posts