Which South African banks offer insurance, and how does the insurance you can get from your bank work? We look at a current breakdown of all the cover options available at South African banks.

Do All South African Banks Offer Insurance?

Most South African banks offer some form of insurance, but not all banks offer insurance products directly. Many banking institutions choose to partner with insurance brokers or financial institutions that already offer insurance. The South African insurance industry is highly competitive, and the products on offer can often be fine-tuned to the consumer’s needs.

For example, Mercantile Bank has a joint venture with Commrisk Insurance Brokers. Their insurance products are not directly from Mercantile Bank, but rather offered through a brokerage. This means if you get insured through them, the company covering you will be another insurance company selected by the brokers.

What Types of Insurance Are Typically on Offer from South African Banks?

The most common insurance type that banks offer is different types of life insurance, such as credit life insurance and cover for loans, such as debt insurance. This makes sense, because credit life insurance is usually there to cover your debt should you pass away. Since your debt is to the bank, having this type of product is logical for a bank.

Many banks offer travel insurance, car insurance, life insurance, and disability or critical illness cover. Business insurance is a less common offering, although some of the banks that offer business and commercial banking also offer forms of business cover.

How Does Insurance from Banks Work?

How your cover works will depend on the bank you get insurance from. To understand how it works, it’s best to understand how insurance works. When you buy an insurance product in South Africa, the insurance company needs to have money that can back their ability to pay out any claims. Some insurance companies, especially newer ones, do not have this portfolio, and so they get underwritten by other insurance companies.

What Does it Mean if an Insurer is Underwritten by Another Insurance Company?

Underwriting is basically reinsurance. It is insurance for an insurance company that doesn’t have an insurance license. Banks sometimes also do not have insurance licenses, and this is why they may partner with other organisations or be reinsured or underwritten by another insurance company.

Often, banks also choose not to carry the risk themselves. Instead, some may partner with a financial institution, such as a brokerage or insurer, to provide products to their customers. Other banks make insurance a pivotal part of their product offering, but not through the banking division of the company.

Discovery is a great example. Discovery Bank does not offer insurance as an entity, but it is part of the Discovery Group, and this group also includes insurance arms, for example, for medical aid. When you bank with Discovery, you can get insurance through Discovery’s insurance arm.

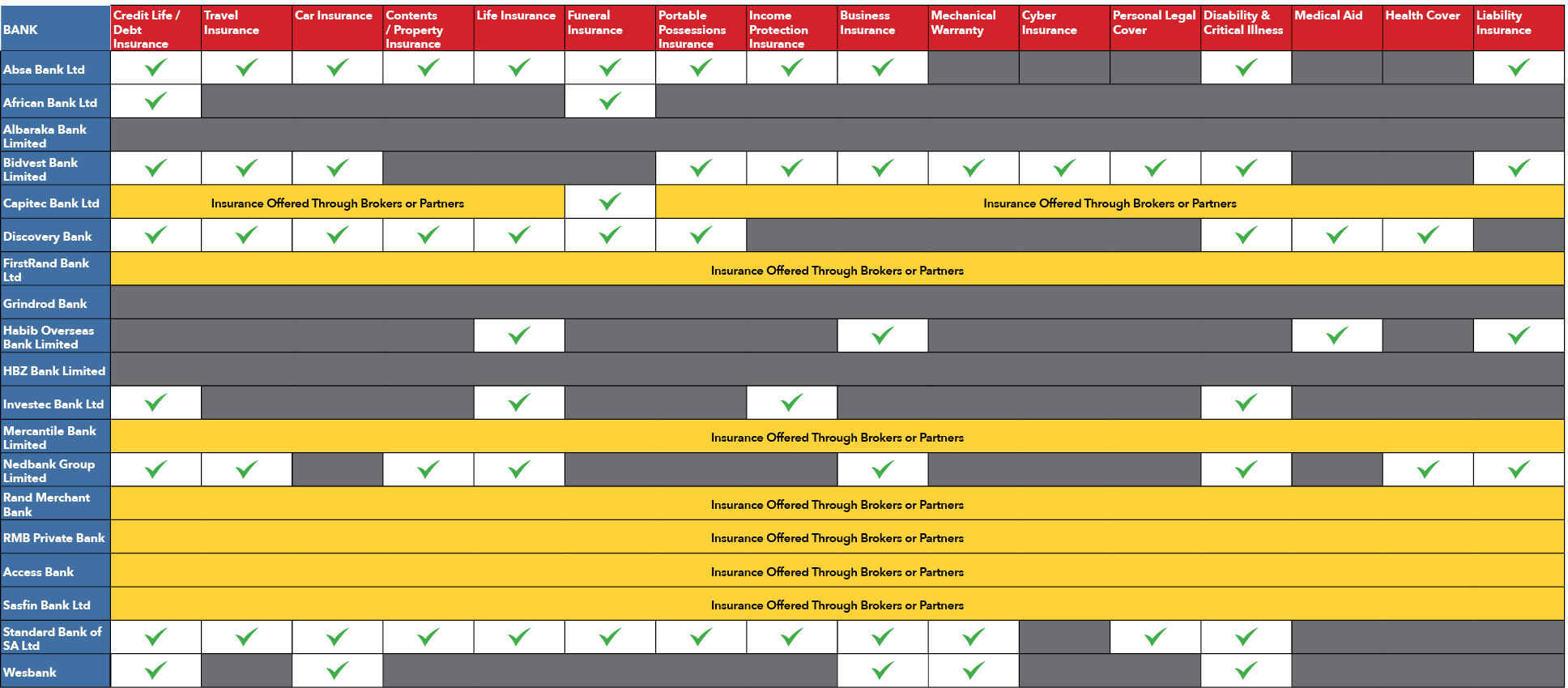

Breakdown of Cover Types Per Bank

Major banks in South Africa are listed below, excluding international banks with a presence in the company. There is a wide range of insurance on offer from banks in South Africa. The below breakdown attempts to summarise the main cover types as a quick overview.

Is Insurance from My Bank Better?

When you get a credit card or different types of loans at the bank, they may include insurance coverage that sounds obligatory. The truth is, it isn’t. You could get insurance for your personal loan online by filling out the form on this page, for example. Insurance from your bank is not inherently better.

The best way to know for sure if the cover your bank is offering is the best is to look at the policy wording and compare it to offers from other insurance companies. You can look at what perils are insured and what exclusions there are. You may be surprised to find better insurance that is more affordable when you compare your cover options.

Benefits of Insurance from Your Bank

When you get insurance from your bank, you can cut down on administration, possibly. For example, if you get car insurance, home insurance, and credit life insurance with the same bank where you have a home loan and a savings account, you can consolidate the administration of these products onto a single platform. You only have to talk to one institution to manage the products.

If you get insurance from different insurers, however, you have more points of contact, which can feel more confusing. But the truth is that you will probably save on premiums and get better benefits when you shop around for the best cover.

Why Compare Cover Options Before Choosing an Insurer?

Credit providers like Standard Bank and ABSA Bank offer credit life insurance because it will benefit them to have the loan insured. Banks are set up to offer you banking products such as savings accounts, loans, and investment opportunities. Banking services are their expertise.

Insurance companies, however, focus on offering customers insurance cover. They’re the experts in insurance, and so it makes sense that there would be more insurance products on offer from them.

You can compare insurance offers through insurance.co.za by filling in the form on this page. Our high-tech system will then match your needs with the ideal insurance provider. Best of all, this insurance company will call you!

Insurance.co.za Content Team

We’re a specialist team of insurance and finance copywriters and content producers. The Insurance.co.za Content Team is a flexible and dynamic team. Hence we publish our content under the Insurance.co.za brand name rather than our personal names.

Other posts